It is important for auditors to assess the risks of a material misstatement in the financial statements. These risks can be assessed by a technique known as analytical procedures.

What is meant by analytical procedures?

Analytical procedures is a method of evaluating financial information through the analysis of financial and non-financial data which can point to areas or relationships that are not consistent with other items in the financial statements and, once identified, can be investigated further to determine if these indicate the risk of a material misstatement. The procedures can also be used to indicate areas of the financial statements that the company auditors should focus their attention on.

Analytical procedures may include the comparison of financial information with prior periods, budgets, expectations and industry information including industry averages and can range between simple comparisons to complex analysis using statistics which can be completed using computer programmes. Ratio analysis is a simple but useful technique which can be used to perform analytical procedures.

Which procedures to use is a matter for the auditor’s judgement and will depend on the size and complexity of the company being audited.

An example of using analytical procedures

Case Study: Cold Coffee Inc

The audit of Cold Coffee Inc has begun and the audit team has obtained the draft profit and loss account. They have begun to assess the risks of a material misstatement and to determine what areas they should focus on. A discussion has been held with the Finance Director who has given them an understanding of the business and an overview of the year under review.

The Finance Director has informed the auditors that Cold Coffee Inc operates 45 coffee shops in the South of England. As well as selling coffee, the company sells a range of sandwiches, pastries and cakes which their customers purchase with cash or card. The reduction of footfall on the high street has meant the company has had a “challenging year” and although the company is currently refinancing its loan facility, the Finance Director does not feel there will be any issues. Budgets have been prepared showing an increase in turnover and profit for the year ended 31 December 2020.

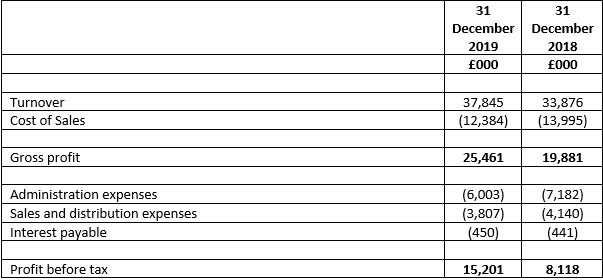

Profit and loss account for the year ended 31 December 2019

The auditors have decided to perform a ratio analysis on the profit and loss account as part of their analytical procedures.

What is the definition of ratio analysis?

Ratio analysis is a simple but useful technique which can be used to perform analytical procedures. It provides insight into a company’s efficiency and profitability by comparing information within its financial statements

Results of the ratio analysis

- The profit for the period has increased from £8,118k to £15,201k which is an increase of 87% while the turnover has only increased by 12% (£33,876k to £37,845k). The auditors consider that this is an area they need to investigate further.

- Although revenue has increased by 12%, cost of sales has reduced by 12%. The auditors consider this to be highly unusual as they would expect an increase in revenue to be matched by an increase in cost of sales.

- The gross profit margin for 2019 stands at 67% compared to 58% in 2018. The auditors would investigate this further and would focus on the changes in both revenue and cost of sales to establish the reason for the increase. The auditors would be concerned that figures have been manipulated to ensure the bank looks favourably on the results and finalises the refinancing package.

- Administration expenses have fallen by 16% which is unusual given that revenue has increased. The auditors are concerned that costs have been understated or incorrectly treated in the financial statements. The auditors would look to carry out a more detailed review of the administration expenses including performing a detailed analytical procedure on a line by line basis to determine where the decreases arise.

- Sales and distribution expenses have also fallen which is not in line with the increase in turnover. More detailed work and investigation would need to be carried out to ascertain the reasons.

- Interest payable remains in line with the prior year and although this does not indicate any risks, the auditors will complete standard audit work in this area including reviewing loan statements.

Now that analytical procedures has been performed, the auditors are aware of the main areas of risk and where they need to focus their attention and what areas to investigate further.

If you would like to discuss your business position in more detail with one of our Corporate Team, please contact us on 01273 701200 or email chrism@plusaccounting.co.uk

Author: Chris Morey, Director, Plus Accounting

Any views or opinions represented in this blog are personal, belong solely to the blog owner and do not represent those of Plus Accounting. All content provided on this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site.