When thinking about whether you should buy or lease a car through your company here are a few things to think about for leasing a car, from a tax perspective.

Corporation tax

- Rentals are corporation tax deductible:

- Full payments are eligible if CO2 emissions are under 50g/km for contracts entered into on or after 1 April 2021 or the car is solely propelled by electric power.

- If the above conditions are not met 15% of the hire costs are not allowable as a corporation tax deductible expense.

VAT

- Can reclaim 50% of the VAT on the rental element of the payments

Benefits in kind

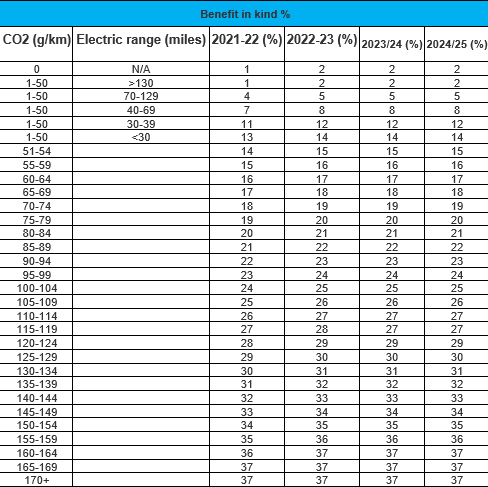

- As with any car provided to an employee and available for private use, benefits in kind will be payable by both the company and the employee. These are calculated using the list price of the car and multiplying by a % based on the CO2 emissions of the car. The % can be seen on the below table for cars registered from 6 April 2020. Please note diesel cars are subject to a 4% surcharge up to a maximum of 37%.

- If employees are paid more than the advisory fuel rate for the business element of fuel used in a company car they will be charged an additional benefit in kind of £24,600 (for 2021/22 tax year) multiplied by the same % as above. The advisory fuel rates are updated quarterly and can be found here.

Alternatives:

- Paying your employee a cash allowance for a car. This allowance is subject to the same tax and national insurance requirements as salary payments.

- Paying your employee mileage for business miles covered in a personal car. This is a tax free payment to employees and the maximum amounts payable are 45p per business mile covered for the first 10,000 miles each tax year (reducing to 25p per mile after this). This can be paid in addition to a cash allowance.

Author: Patrick Hoare, Corporate Services Manager, Plus Accounting

Any views or opinions represented in this blog are personal, belong solely to the blog owner and do not represent those of Plus Accounting. All content provided on this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site

Date published: 06 May 2021