Bank rules makes your bank reconciliation easier, quicker and more accurate.

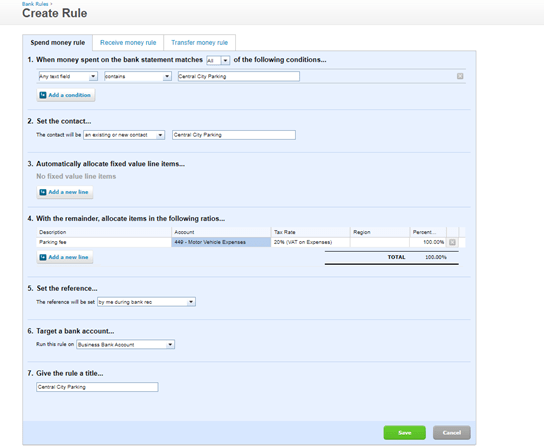

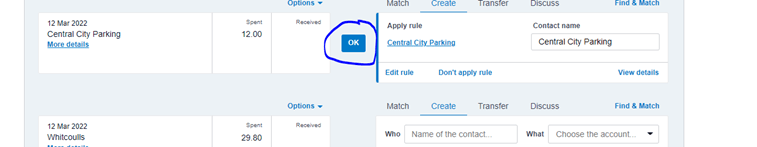

Once the rule is set up with the supplier details, account and vat code, it will ensure that this expense is posted to this same account, using the VAT code specified, each time.

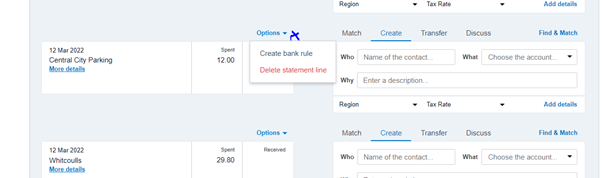

Bank rules are very easy to set up and can be created while in the bank reconciliation screen. They are ideal for regular payments, where you would not usually have a purchase invoice, for items such as bank charges, monthly insurance payments and parking.

If you do your bank reconciliation through the cash coding tab, all the costs which are posted via bank rules can literally be reconciled immediately, by just pressing the green save and reconcile tab.

If at any time you wish to amend these, you just edit the rule and make the necessary changes required.

If you wish to find out further information on how Bank rules can work for you, please contact the Plus Advisory Team.

Author: Debbie Marriott, Xero & VAT Advisor @ Plus Accounting

Contact me on 01273 701200 or email debram@plusaccounting.co.uk

Date published: 11 April 2022